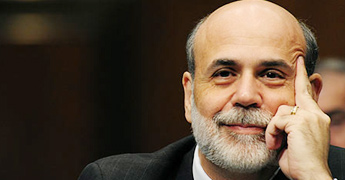

The major question that is arising in the minds of the average Americans is that is the US going the Japanese way or is it going to revive. Many economists think that the US could see a moderate, but steady recovery over the next few years. But, as the Chairman of the Federal Reserve Ben Bernanke emphasised, that will require some difficult decisions by politicians, including a credible plan to low federal borrowing long-term, without hobbling the recovery next year by withdrawing the stimulus too quickly.

The major question that is arising in the minds of the average Americans is that is the US going the Japanese way or is it going to revive. Many economists think that the US could see a moderate, but steady recovery over the next few years. But, as the Chairman of the Federal Reserve Ben Bernanke emphasised, that will require some difficult decisions by politicians, including a credible plan to low federal borrowing long-term, without hobbling the recovery next year by withdrawing the stimulus too quickly.

US manufacturing output slowed to its lowest rate of growth in two years in August, a report said. The Institute for Supply Management's (ISM) index of national factory activity declined to 50.6 last month from 50.9 in July.

US consumer confidence slumped in August to its lowest level since April 2009, according to the latest monthly Conference Board report. Its closely watched consumer index sank to 44.5 this month, from a downwardly revised 59.2 in July.

It is the first time since 1945 that there has been a zero payrolls figure. A strike by 45,000 Verizon workers reduced the figure, as striking workers do not appear on payrolls, although those employees have now returned to work. Average hourly earnings fell by 3 cents to $23.09, while the average working week dropped to 34.2 hours from 34.3 hours in July. The jobs picture was already bleak at the start of the year - but, if anything it now looks even worse, with unemployment still hovering around the 9% mark, and a record 40% of the jobless now unemployed for more than six months.

"US companies have no confidence in the US economy and no confidence in the country's political leadership, so it's no surprise no jobs are being created," said Max Johnson at Currency Solutions. "The US economy is looking increasingly forlorn and this latest jobs data will apply further downward pressure on the dollar."

There have been times, in the past few years, when US policy makers weren't sure how the financial crisis was going to play out. But on one point they were absolutely certain: the US would not - could not - go the way of Japan.

Minutes of the Federal Reserve's latest Open Market Committee (FOMC) meeting have shown the highest level of dissent among its members for 19 years. Three of its 10 members voted against the decision that interest rates should remain at their current low level of between 0% and 0.25% until mid-2013. US government bonds rallied after the figures were released. The yield, which is the implied cost of borrowing, of the 10-year Treasury bond fell instantly from 2.13% to 2.03%, in anticipation of a possible further round of debt purchases by the Federal Reserve.

Inspite on cutting down on outsourcing and benefits for encouraging in creating local employment the Obama government seems to have left behind a legacy of an all time low statistics, which can be recouped only if backed by a stern and optimistic agenda taking in to consideration the ground realities. The statistics as reported as on the Internet from various info sources.