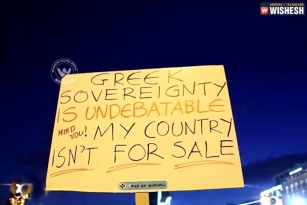

Greece's last-minute overtures to international creditors for financial aid, were not enough to save the country from becoming the first developed economy to default on a loan to the International Monetary Fund (IMF). The IMF confirmed that Greece had not made its scheduled loan repayment of 1.6 billion euro to the fund. IMF Managing Director Christine Lagarde said that it will report this to the global lender's board that Greece is "in arrears," the official euphemism for default.

The after effect will be that the Indian corporate may face higher borrowing cost in the overseas market in the short-run, India Ratings and Research (Ind-Ra) has said. "India's direct exposure to Greece through external trade is minuscule. A contagion effect may lead to a 'risk off' scenario, increased volatility and capital flight. The biggest single-day debt outflow from the Indian market was $2 billion on September 17, 2008, post Lehman's collapse," it said.

Indian firms have raised foreign capital to the tune of $13.4 billion in 2014-15 and the cost of such borrowing may now go up. Ind-Ra expects increased global market volatility to weigh on the rupee in the near-term.

Greece's bailout program has ended on yesterday, the country has failed to make a 1.6 billion euro ($1.8 billion) repayment to the International Monetary Fund. Greek PM Alexis Tsipras has called a referendum and has shut down the banks for a week and imposed a daily ATM withdrawal limit of 60 euros.

Finance secretary Rajiv Mehrishi has said that the economic crisis in Greece may trigger capital outflows from India and the government is in consultation with the RBI to deal with the situation.

Due to the Greece crisis, India's software and engineering exports may take a hit, industry and government officials warned. Engineering exporters' body EEPC India said the economic crisis in Greece will impact engineering exports from India as European Union is the largest destination for such shipments. The industry body expects indirect impact from the UK, Italy, Turkey and France.

By Premji