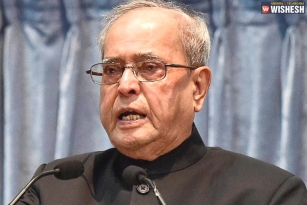

The Union Finance Minister, Pranab Mukherjee today announced that the tax exemption limit has been raised from the present Rs.1.6 lacs to 1.8 lacs per annum. The Union Finance made a statement to this effect in Lok Sabhya today on the eve of presenting his sixth General Budget in the Lok Sabha. Also, he proposed to reduce the qualification age of senior citizens from the existing 65 to 60 years. Significantly in this year's budget speech, Pranab Mukherjee sought the heavenly intervention of Lord Indra for good rain and Goddess Laxmi for good fortune.

The Union Finance Minister, Pranab Mukherjee today announced that the tax exemption limit has been raised from the present Rs.1.6 lacs to 1.8 lacs per annum. The Union Finance made a statement to this effect in Lok Sabhya today on the eve of presenting his sixth General Budget in the Lok Sabha. Also, he proposed to reduce the qualification age of senior citizens from the existing 65 to 60 years. Significantly in this year's budget speech, Pranab Mukherjee sought the heavenly intervention of Lord Indra for good rain and Goddess Laxmi for good fortune.

The salient features of the Union Budget for the year 2011-2012 are:

1) Allocation for Credit loans to farmers to go up from Rs.3.75 lakh crore to Rs.4.75 lakh crore

2) Persons aged above 80 covered under the Indira Gandhi National Old Age Pension Scheme,to get monthly pension of Rs.500 as against Rs.200 now

3) Surcharge for corporates reduced to 5 per cent, from 7.5 per cent

4) Service tax widened to A/C restaurants serving liquor, some category of hospitals, diagnostic tests

5) Special allocation of Rs.100 crore to IIT, Kharagpur

6) Rs.30,000 crore to be mopped up through tax-free bonds

7) FIIs to be allowed to invest $40 billion in corporate bonds

8) Direct Taxes Code (DTC) to make way for the existing Income Tax Act, from 1st April next year

9) New Service tax on Domestic, International Air Travel, to be charged at Rs.50 and Rs.250 respectively

10) SEZs to come under MAT(Maximum Alternate Tax)

11) Rs.40,000 cr to be raised throuth Disinvestment in 2011-2012

12) Lower rate of 15 per cent tax on dividends received by an Indian company from its foreign subsidiary.

13) IT Returns to be done through E-returns and E-payment of Taxes

14) Ex-gratia compensation for the disabled Army, Para Military Personnel to get Rs.9 lakh

15) Rs.8000 crore to be set apart for the development needs of J&K

16) Exclusive allocation of Rs.200 crore to be given for clean-up of some important lakes and rivers other than Ganga

17) As part of recognizing talent, Universities and Academic Institutions are to be provided with special grants

18) Allocation for Bharat Nirman programme hiked to Rs.68,000 cr from the present Rs.58,000 cr

19) Financial Assistance to be lent to metro projects in Delhi, Mumbai,Bengaluru, Kolkata and Chennai

20) Allocation of Rs 21,000 crore for the literacy mission

21) Special Task force to deal with black money

22) Coins with new Rupee symbol soon to be issued soon

23) PSU banks to get capital support of Rs.6,000 cr