Many leaders across the country have expressed contradictive views on the issue, but we would like to gather info from all available sources and keep it in front of you to decide.

The central government last week allowed 51% FDI in multi-brand retail with stringent conditions on back-end investments, market accessibility and sourcing. But the move has run into widespread opposition from almost all opposition parties, paralyzing the Parliament. The major global players like Walmart will set shop in India. The long-awaited decision by the Cabinet will allow retailers who sell multiple brands of products to own 51 per cent of their Indian operations, with the rest held by an Indian partner.

Well the analysis released today by CRISL states foreign direct investment (FDI) in multi-brand retail will stimulate investment in Indian retail. CRISIL estimates FDI inflows of USD 2.5–3.0 billion over the next five years, modest in the context of overall FDI inflows of USD 160 billion in India over the past five years. According to CRISIL, the food and grocery (F&G) vertical would attract a larger share of the likely FDI inflows. The clause specifying 50% investment in back-end infrastructure especially aligns with the commercial requirement in the F&G segment. F&G accounts for two-thirds of Indian retail sales, but currently has organized retail sales of only around 2%, the lowest among retail verticals.

Leading Columnist and former Union Minister Shashi Tharoor expressed that when investment comes from abroad, many people get work, new constructions take place, new shops are created, and consumers have to pay less. After carefully watching all this, our situation is slightly different; the shops have come up in China. You should ask that why FDI is not in India, but it is in different countries.

The optimists argue that FDI policy should not be banned in India. In fact it should be encouraged like in other countries too. It is going to be an asset to our country. Such a move should not be banned because such outlet bills everything they sell and the billed money goes to taxation. True there is going to be tough competition for retailers but commercial giants like Walmart are coming here for the consumers like us. Global players have a perfect supply chain management, which squeeze the best deal from manufacturers and pass the benefit to consumers, that way it is an asset. Competition in the market is always good for consumers.

Another India's largest and most influential trade lobby, the Confederation of Indian Industry and the Federation of Indian Chambers of Commerce and Industry have not only supported the government's move, that will in many ways revamp the retail sector, but also argued that the induction of foreign investors in the segment will benefit both the consumer and the small traders in the long run. The CII has recommended a calibrated approach for introducing foreign investment in the retail sector in terms of the percentage and minimum capitalization requirements.

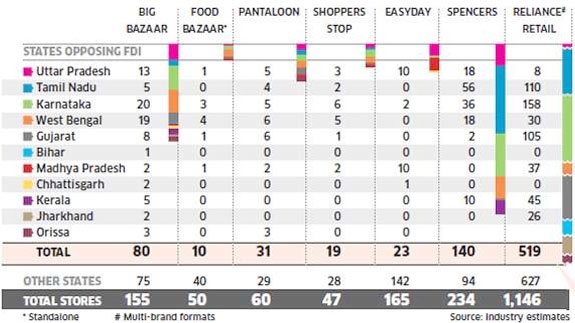

Now let us analyze what the other side of the coin report. In fact, states arguing about kirana stores being impacted by foreign retailers have permitted rapid expansion of modern retail and large hypermarkets, pushing the overall share of organized retail from around 4% in 2008 to nearly 7% in 2011.

Vyapar Rozgar Bachao Aandolan, a Movement for Retail Democracy, an alliance of mass based organizations traders, hawkers, farmers, trade unions, cooperatives, Consumer groups and civil society organizations in coordination with organizations around the country organized a National Day of Action in August, in commemoration of the Quit India Movement.

The Tamil Nadu Chief Minister said there shall be no FDI in the state. She further added `there is fear that this move will completely throttle small retailers and distributors. As this will affect the livelihood of millions of small departmental store owners and completely destroy the unorganized retail sector within the next couple of years, I strongly oppose this move of the Government of India to open up the retail trade to Foreign Direct Investment.’

Reacting sharply to such a proposal the Bharatiya Janata Party (BJP) leader Uma Bharti said, `If Walmart opens its outlet, I would personally set afire the showroom and I am ready to be arrested for the act.’

The government’s decision to Source 30% inputs mandatorily from Indian micro and small enterprises (MSE) on Monday too did not cool the oppositions.

This was the second such incident which created much uproar in the parliament after the nuclear issue. The issue now lies in the hands of the educated public whether they want or not.