The Ministry of Finance constituted a Committee under the Chairmanship of M. D. Mallya, Chairman Bank of Baroda for examining the textile restructuring proposals. The Committee identified a sizable exposure of banks to the textiles sector of Rs. 146885 crores.

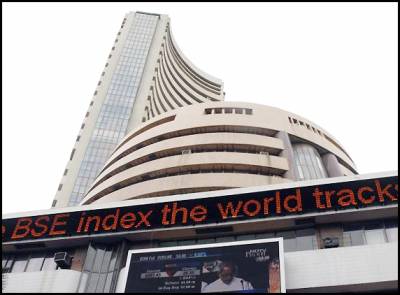

Minister of State for Textiles, Smt. Panabaaka Lakshmi said in the Rajya Sabha on Wednesday that the Confederation of Indian Textiles Industry has reported that out of 287 companies listed in the Bombay Stock Exchange, 122 companies have reported net losses in Q1 of 2011-12 and 166 companies have shown poorer results compared to previous year. Many companies are reported to be finding it extraordinarily difficult to repay term loans and finance working capital and have reported that they may default on loan repayment. The highest price volatility in cotton prices in the past 150 years followed by a collapse in April, 2011, had immediate repercussions in the domestic market. Cotton yarn production is down by 15% and fabric production is down by 19 % in the April – October 2011 period over the previous year. Textile Mills faced with high priced cotton inventories could not pass through the prices into yarn and fabrics as the price decline came suddenly in the month of April 2011. This led to a slowdown in production and reduced utilization capacity.

The Ministry of Finance constituted a Committee under the Chairmanship of M. D. Mallya, Chairman Bank of Baroda for examining the textile restructuring proposals. The Committee identified a sizable exposure of banks to the textiles sector of Rs. 146885 crores. The Committee recommended a restructuring package that sought relaxation in prudential norms by RBI for banks to restructure working capital and term loans.

The proposal was submitted to and examined by Reserve Bank of India (RBI) which advised that banks are free to restructure any account, whether standard, substandard or doubtful as also more than once, provided the financial viability is established and there is a reasonable certainty of repayment as per the terms of the restructuring package but clarified that it was not in favour of relaxing its prudential guidelines on restructuring of advances, provisioning norms, risk weights etc for any specific sector or industry.