(Image source from: India.com)

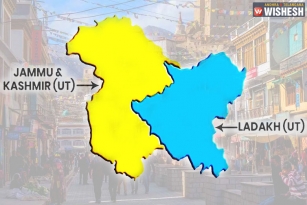

Seven Years Tax Exemption for Jammu and Kashmir:- The Centre took a bold step, scrapped Article 370 for Jammu and Kashmir. The state was announced into two union territories as Jammu and Kashmir along with Ladakh. The state was taken into control from the past one month to prevent any unexpected violent situations. The Centre announced a tax holiday for seven years for all those who invest in the state. Right from GST, the state will get all the tax exemptions for seven complete years. 11 Union ministries worked on the deal and finalized the proposals.

A special package has been announced for Ladakh by the Centre. Every village will get five government jobs. All the local youth will be given a chance to join CRPF and BSF troops. All the allowances given to the cops in the other states will be given for these troops. All the salaries in the government offices will be revised. The electricity charges will be reduced. New corporate hospitals along with the educational institutions will be set up in Jammu and Kashmir.

All the children below the age of 14 will be given free education and a new law will be proposed. Investment and business meetings will be held for new investments. The Centre is in plans to support Jammu and Kashmir in all the available ways.