Telangana Govt Receives More Than 1,500 GST Violation Complaints In Just 2 Days?

July 04, 2017 11:48

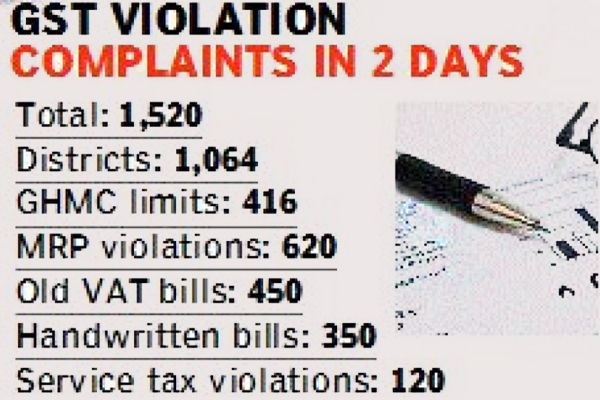

Telangana Govt Receives More Than 1,500 GST Violation Complaints In Just 2 Days?:- The Telangana Government, within two days of GST coming into force, has received more than 1,500 complaints of shops, hotels and commercial establishments.

In the complaints, it was alleged that they are selling products above MRP on the pretext of higher tax slabs. Where there was more confusion, due to four categories of GST rates in AC and non-AC categories, the violation was found to be upright in hotels. Citing the higher GST tax rates, the bakeries were found to be increasing the prices of bakery products.

From semi-urban and rural areas in districts, 70% of the complaints were received, while 30% of the complaints were from the GHMC limits, interestingly. Where the consumer awareness levels on GST were comparatively lower than urban consumers, the traders and shopkeepers were resorting to irregularities in semi-urban and rural areas, said the officials.

The traders and shopkeepers of severe action, if they resorted to irregularities by Commercial taxes secretary Somesh Kumar. The GST Act enables the government to cancel GST licences of such traders and shopkeepers, said Mr. Kumar.

“We have asked our officials and staff to focus more on semi-urban and rural areas, which are prone to exploitation. They have been asked to take up inspection of shops and commercial establishments and interact with consumers to know their grievances,” he said.

A major challenge to the government, has been posed by the implementation of GST in the services sector. Payments in cash were sought by beauty saloons, photography laboratories unregistered cab services and mechanic shops.

A photo developing laboratory in the city billed Rs 1,700 for enlarging pictures, but asked the customer to make the payment in cash to avoid 18% GST. A complaint has been registered against it. There is a high scope for evading tax where the service sectors that have minimal or zero raw product exchange, no online transactions or no billing system. The goods could be tracked through transportation, production, depots, physical inspection and more, said the officials. If the service provider and the customer came to an understanding over cash payments, it would be difficult to track transactions, in service sector.

SUPRAJA